Recent Blogs

Our Services

Explore Our Comprehensive Service Offerings

Tailored solutions for every stage of your business every stage of your business.

Strategic Growth Through M&A

Strategic Growth Through M&A

Our end-to-end M&A services include Target/Buyer Search, Deal Advisory - Buy & Sell Side, Valuation Support, Due Diligence, JV Advisory, Sector Research, Business Plan & Valuation Assessment, Strategic Transaction Support backed by deep India expertise and global best practices.

Accelerator

Accelerator

Launched in 2015, the Maple Accelerator is designed to help startups scale through expert mentorship, financial guidance, and access to a curated network of investors and industry specialists. We focus on asset-light business models across sectors such as Agritech, Consumer tech, B2B tech and digital businesses, empowering high-potential companies to achieve accelerated growth

Private Equity

Private Equity

We provide expert advisory in Private Equity focusing on buyouts, growth capital, and special situations. We also offer customized capital market solutions for venture capital, Pre-IPO financing, and preferential allotments. Our deep network of India-focused funds enhances our ability to provide exceptional support in these areas.

Leverage Finance

Structured Finance

We deliver strategic financing solutions, ranging from working capital and project financing to mezzanine and convertible debt. We emphasize on strategic structuring and effective negotiations with lenders ensuring that client’s needs are met comprehensively.

Wealth Management

Wealth Management

Maple Capital Services LLP, an affiliate of Maple Capital Advisors, is dedicated to a client-focused strategy, drawing on nearly two decades of industry experience and professional certifications. We specialize in wealth management for family offices, high-net-worth individuals, and senior executives. Our offerings include a variety of products such as structured equity & debt products backed by research from leading partner firms.

Team

Our Expert Team

Meet the dedicated professionals behind our success.

Mr. Pankaj Karna

Founder & Managing Director

30+ years of experience in investment and corporate banking; featured by IBEF among India’s top entrepreneurs; former Head of M&A at Grant Thornton and Director at Rabobank. Studied at McGill University, Canada, Manipal Institute of Technology, Manipal, St. Stephen’s College, Delhi and Mayo College, Ajmer.

Recent Transactions Overview

Explore our latest successful transactions and partnerships.

Maple Capital Advisors acted as sole financial advisor in the Strategic Acquisition of Qandle by Mynd Solutions

Maple Capital Advisors acted as the sole financial advisor to Corporate Edge for INR 1,000 Mn private equity investment from CarpeDiem Capital

Maple Capital Advisors acted as financial advisor to Piccadily Agro Industries Limited for INR 2,620 Mn preferential allotment with Institutional Investors and HNI

Maple Capital Advisors acted as sole financial advisor to Awfis Space Solutions Limited for sale of its Facility Management business to SMS Integrated Facility Services Private Limited

Maple Capital Advisors acted as sole financial advisor to Skye Air Mobility Pvt. Ltd. for USD 4 Mn private equity investment from Mount Judi Ventures, Chiratae Ventures, Venture Catalyst, Tremis and Windrose Capital

Maple Capital Advisors Acted as sole advisors to U Games Private Limited for sale of its gaming asset Ultimate Teen Patti to Nazara Technologies Ltd./Next Wave Multimedia Pvt. Ltd.

Recent News & Updates

Explore our latest articles and insights.

March 6, 2025

Carpediem Capital invests Rs 100 crore in CorporatEdge

CorporatEdge plans to deploy Rs. 350 crore in the next three years. It will unveil two centres, each spanning across 50,000 sq ft, in Q1…

Learn More

May 9, 2025

India’s Agritech Revolution: Maple Capital Advisors & IDC Unveil “Agritech in India: Investment Trends” Report

The ‘Agritech in India: Investment Trends’ report by Maple Capital Advisors and IDC reveals that since FY22 Indian agritech has attracted over $2.6 billion in…

Learn More

March 7, 2025

Flexible Workspace Provider CorporatEdge Raises INR 100 Cr to Fuel India & Middle East Expansion

Premium flexible workspace provider CorporatEdge has secured INR 100 crore in equity funding from Carpediem Capital, a mid-market private equity firm focused on growth-stage investments…

Learn MoreFAQs

Have a Question?

We focus on high-growth sectors such as Consumer (Retail, FMCG, Food, Healthcare, Education), Agribusiness in India Business Services, Technology, Tech-enabled industries, and Manufacturing backed by strong sector expertise and a deep understanding of emerging opportunities in India and globally.

We have extensive experience in advising on cross-border M&A, inbound alliances, and joint ventures. Our understanding of Indian regulatory frameworks, combined with a strong international network through Pandion Partners, helps clients structure and execute seamless global transactions.

Maple’s investment network includes private equity firms, family offices, venture capitalists, and strategic investors both in India and internationally.

In our core business we typically focus on $5-100 Mn range for M&A and Capital Raising. Under our Accelerator Program we invest at seed stage/concept and selectively advise promising partners for Pre Series A rounds.

We take a holistic approach to wealth management, considering each client’s unique financial goals, risk appetite, and investment horizon. Our solutions are tailored to deliver optimal returns while preserving and growing wealth growing wealth, backed by comprehensive benchmarking and leading research.

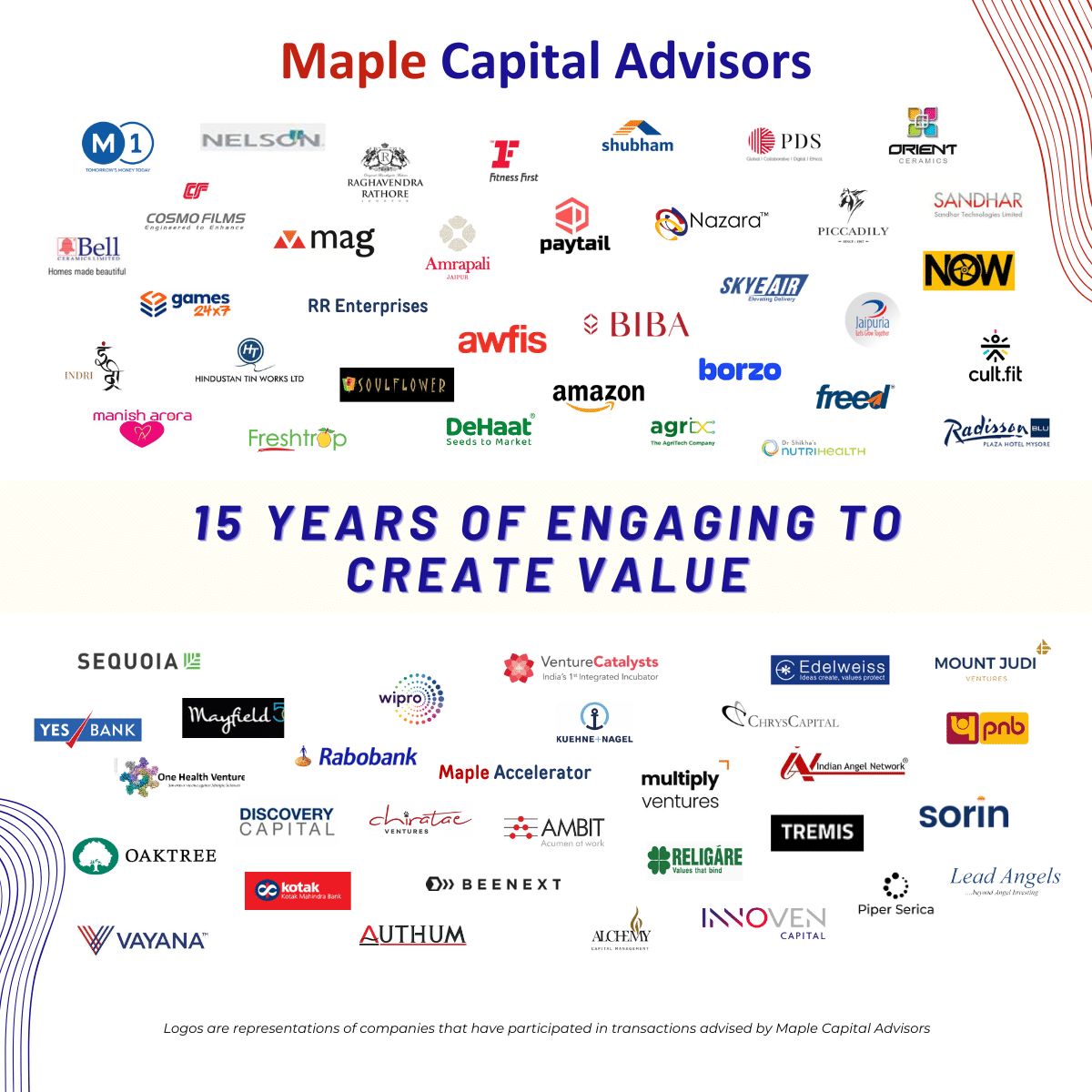

Trusted by Industry Leaders

Reach Us!

If you are contemplating exploring strategic options for your business, raise capital or seek financial & strategic solutions, reach us at

If you are exploring a career in Investment Banking from premium investors with track record in Investment banking, please reach out to us at